- #AVERAGE HOUSEHOLD MONTHLY EXPENSES HIGH INCOME OFFLINE#

- #AVERAGE HOUSEHOLD MONTHLY EXPENSES HIGH INCOME TV#

When your monthly expenses are too high for the size of your paycheque. Splitting household bills will also cut down on living costs. Gross SV salary per month without holiday allowance, 1,995.00. If youre spending more than your income, it can be difficult or feel impossible. Median household income (or 5,899 a month). Housing accounts for more than a third (37) of monthly household final. Splitting the cost of rent with a partner or friend can make it a lot cheaper and open up more options. Whether you are in a family of 2, 4, or more, average monthly expenses for any family is pricey. 15 December 2022 New app available for the survey of income and expenditure. It’s a good idea to visit and speak to your housemates before moving in, so you can make sure you all get along. It’s also an excellent way for people moving to a new place to make friends. Looking a bit further out of the centre of a city or town can sometimes be cheaper.įor first-time renters, moving into a shared home can be a simple way to save money on rent. For example, you may have planned on living in a house, but there could be a decent flat in your price range. The following might help when looking for a home to rent using your new budget:īeing flexible about the location or choose a different style of property can help you get more for your money. If you’ve worked out a budget and know your top end for spending on rent, you might not be able to live exactly where you imagined. Way you might be able to reduce your rental costs From the amount left, figure out how much you could afford to spend on rent and how much you can put into your savings.Īlways leave spare money for emergencies or seasonal costs (think birthday presents, weddings, Christmas). Subtract these outgoings from your after-tax wage.

They will probably have an average amount that they can provide. You can also ask the landlord or letting agent if they have an idea of the costs for bills in your area. Transportation: 747 per month 8,963/year Health care. Remember that bills are not automatically the same when you move – council tax may increase or decrease, as will energy and transport costs. Monthly costs range from 1,666 for a single-child family to 4,069 for a family with four kids.

#AVERAGE HOUSEHOLD MONTHLY EXPENSES HIGH INCOME TV#

To begin, create a budget, including food, travel, social, subscriptions, savings and bills.īills should include council tax and utilities like energy and water, TV licence, broadband and digital TV services and insurance. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs.Working out your monthly outgoings can help you to understand how much you can afford to spare for rent. These ads are based on your specific account relationships with us. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements.Īlso, if you opt out of online behavioral advertising, you may still see ads when you sign in to your account, for example through Online Banking or MyMerrill. If you opt out, though, you may still receive generic advertising. However, if you happen to have young children in daycare, have high education costs. If you prefer that we do not use this information, you may opt out of online behavioral advertising. The guidelines suggest you spend 5 10 of your income in this category.

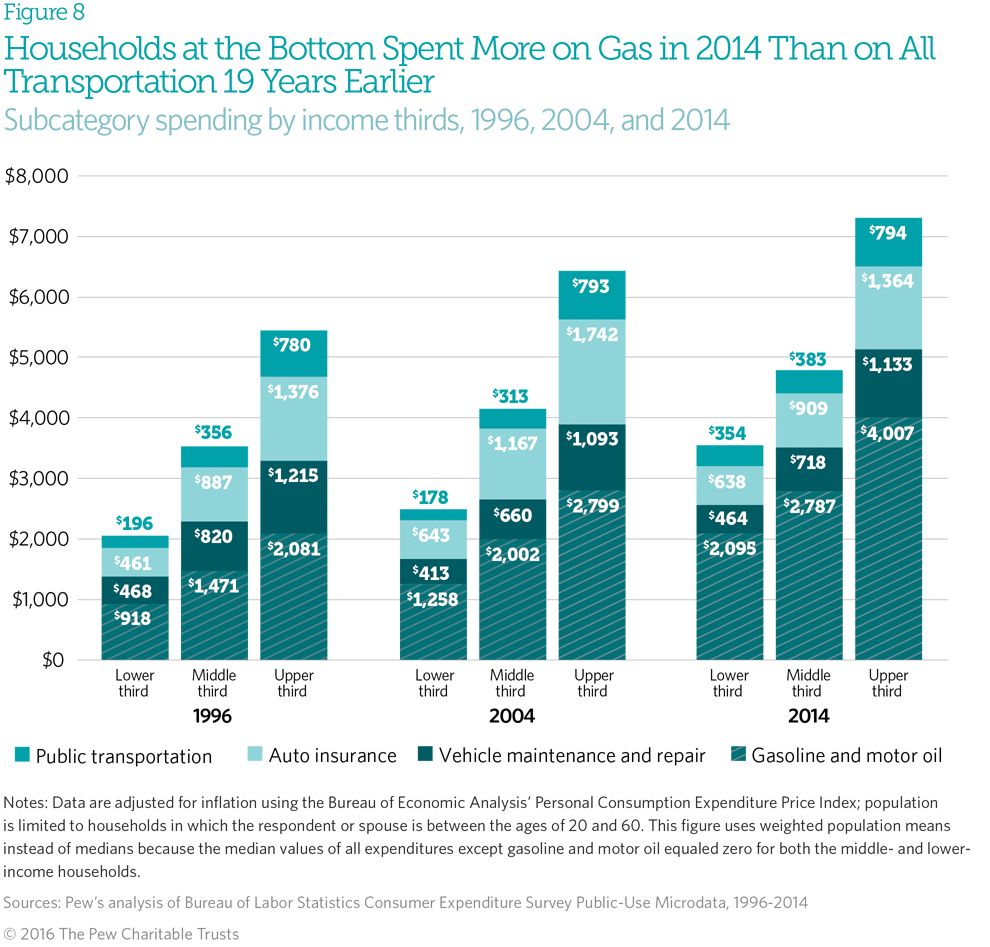

Food is the second highest followed by car costs which include petrol.

#AVERAGE HOUSEHOLD MONTHLY EXPENSES HIGH INCOME OFFLINE#

This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Accommodation costs top the list with home loans, rates, utilities and maintenance. But living on the edge financially is nothing new in the U.S. A general rule of thumb says housing costs should be no.

Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. In the pandemic, a third of Americans struggle to pay usual costs, even some earning over 100,000. Most budgeteers will normally have rent or mortgage costs as the bulk of their monthly housing expenses. Relationship-based ads and online behavioral advertising help us do that. 50 of your income on needs: essential living expenses, such as rent/mortgage, bills, food and transport to work 30 on wants: discretionary spending, such as. This includes the utility costs, such as internet and electricity bills. We strive to provide you with information about products and services you might find interesting and useful. The average cost of household expenditure will hover around Rs 10,000 per month.

0 kommentar(er)

0 kommentar(er)